This article looks at how the COVID-19 pandemic and other events created a price structure in futures and spot markets that incentivizes market participants to store crude oil in the United States.

Nicole Moran and Laurent Samuel of Cornerstone Research coauthored an article titled “‘Contango With Me’: COVID-19 and the U.S. Crude Oil Market.” A link to the full article appears at the bottom of the page.

Consumption of crude oil in the United States has plummeted since the start of the COVID-19 pandemic, and production was unable to adjust quickly to these abrupt changes. This contributed to oil prices decreasing by nearly 70 percent since the beginning of the year.

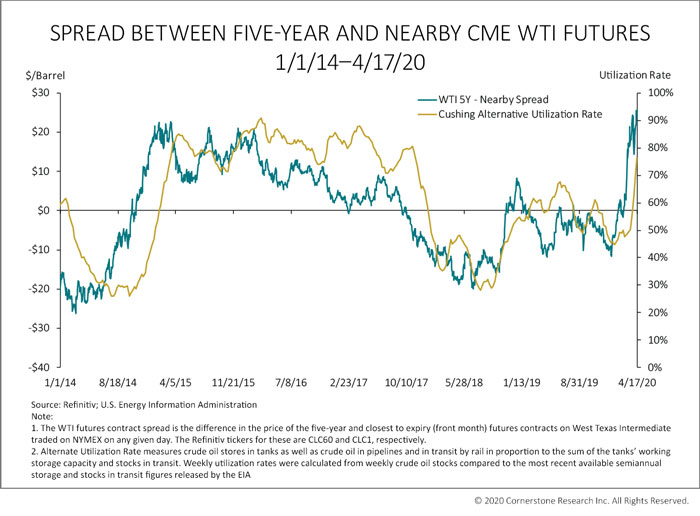

The price drop was much sharper for nearby contracts (contracts delivering soon) than for contracts delivering further in the future. The spread between the nearby and the five year deferred WTI futures increased by over $20/barrel in the span of a few weeks. This “super” contango in the price structure has created a huge incentive for market participants to store barrels rather than sell them in the spot market for nearby delivery. The increase in physical stocks has been so massive the IEA warned it could “overwhelm” storage capacity.

The views expressed herein do not necessarily represent the views of Cornerstone Research.